- Joined

- Sep 11, 2013

- Messages

- 62

- Reaction score

- 0

I pre-ordered it.

I'm not hating at all BTW. I am a fan; I love the company and love the products. But when we occasionally get slapped with unjustifiable prices, I'm not going to fan them and feed them grapes when I feel like I'm getting pissed on. When the math adds up I always praise them, but when it doesn't it's usually insulting

I'm not hating at all BTW. I am a fan; I love the company and love the products. But when we occasionally get slapped with unjustifiable prices, I'm not going to fan them and feed them grapes when I feel like I'm getting pissed on. When the math adds up I always praise them, but when it doesn't it's usually insultingyou know i understand that the craftmanship has increased over the years... but it in no way comes close to the price increase. you look at the blade figure from a few years ago. he has accessories out the wazoo... looks incredible, outstanding details and killer sculpt... and is $160 less than this reissue figure w/ none of the accessories. hell even the mk7. 5 times the accessories, same 2 heads, same electronics and $75 cheaper. drop the BS diecast myth/justification. its pennies on the dollar price difference for it. its gimmick, not much more...

it just gets irritating... the people running the show think that gimmick = $$ when in fact its peoples' addiction that = $$. the addict's "ohhh instabuy... gotta have it... po'd but hate myself" mentality is what keeps these prices going to a range that is going to eventually push the majority away. and it pisses me off! ruining something i enjoy with greed. you would think that someone in charge would be saying "hey lets sell 10000 of these at $200 vs sell 4000 of these at $345"end of rant... before i go home and burn all these things!!! lol

sorry i gotta disagree with you. i think you are misreading what people are saying. its not that they are slapping a repaint on the figure. its that they are slapping a repaint on a figure that was already over priced... and adding $60 to it. understand it has a reused head from IP, but still doesnt come close to justifying the price increase. if these things were the same price as its identical predecessor this bad blood brewing wouldn't be there to the extent it is. and its quite the contrary... people love them, love this hobby... the totally unjustified amount of price jacking is what's ruining it. so its a hate not on the product but the BS greed levels from the parent company.

ps... we're all paying almost 1/2 the price for gas as i've been the past few years. so it should be reflected in my shipping costs no? which should reflect in cheaper figures no?

Well said and agreed on all counts

Did anyone actually order this yet?

Well said Mike. I agree with what your saying. This deserves a Rep Point!3%-8% profit margins? I don't think that any company or person can be successful, let alone survive on that. Pre-recession savings accounts gave 3% interest rates an you could find CD's at the time that would offer around 8%. I'm not sure where you're getting these numbers from but if that were the case, companies like apple wouldn't bother working for a living and would just invest their money in CD's

I can assure you that the most successful companies are absolutely making 200, 300, 500...1000%+ on their investment. Restaurants aim to make 25%-35% per plate, General contractors typically look to make 20%-30% when bidding jobs. Those are examples of profit margins on the smaller side of the spectrum. Diesel for example sells $180-$200+ jeans that cost them....less than $15 to produce per pair. Do you really think that Apple makes 5% (the median of what you suggested) profit on every 64GB Touch they sell? So it costs them $285 to produce an item that they sell for $300?

"Minimize costs and maximize profits" is the very core philosophy of business economics. The late great Tupac said "I'm tryin' to make a dollar outta 15 cents"... not "I'm trying to make 3 cents on the buck".

BTW, I hope that I'm not coming across like I'm arguing with you, because I'm not. This is just a conversation in case my virtual voice suggests otherwise

To answer your question, I don't see HT's books so I don't have hard numbers to prove what I'm saying, but the little that I do know helps me guesstimate roughly:

Sideshow gives their retailers a 30% wholesaler discount (Diamond gives 50%). Giants like BBTS possibly get a little more like 35% (which was what all SS retailers used to get before they got snipped 5%). So that means that a $200 Hot Toy costs a retailer $140. Sideshow makes money by selling it for $140. So based on that little bit of info, my question to you is what do you think SS's cost is? And then in turn, what do you think HT's cost is since they profit when selling it to SS?

There are other things to consider like the difference between US's & Asia's MSRPs, and what it costs SS to freight everything, but I'm keeping the equation simple and I'll stop boring everyone with this bulls__t

Maybe 600% was a little over estimate, but based on all the reuse, I'll wager that each of these WM EX sets cost HT $70-$90 to produce

How many of you would have justified paying for a die-cast War Machine Mk. I from IM2 instead?

How many of you would have justified paying for a die-cast War Machine Mk. I from IM2 instead?

The way a vast majority of us reacted when we first laid eyes on this release.

FU Aston Kutcher I want this ***** to go down on me,

3%-8% profit margins? I don't think that any company or person can be successful, .........

Maybe 600% was a little over estimate, but based on all the reuse, I'll wager that each of these WM EX sets cost HT $70-$90 to produce

Well said Mike. I agree with what your saying. This deserves a Rep Point!

Well said Mike. I agree with what your saying. This deserves a Rep Point!

Sucks balls being pissed about something we should be all be loving huh?!??

There are far more factors to consider then just the cost to make the figure, such as advertising, importation fees, taxes, etc. But what would I know, I have only been collecting this stuff for 40 years

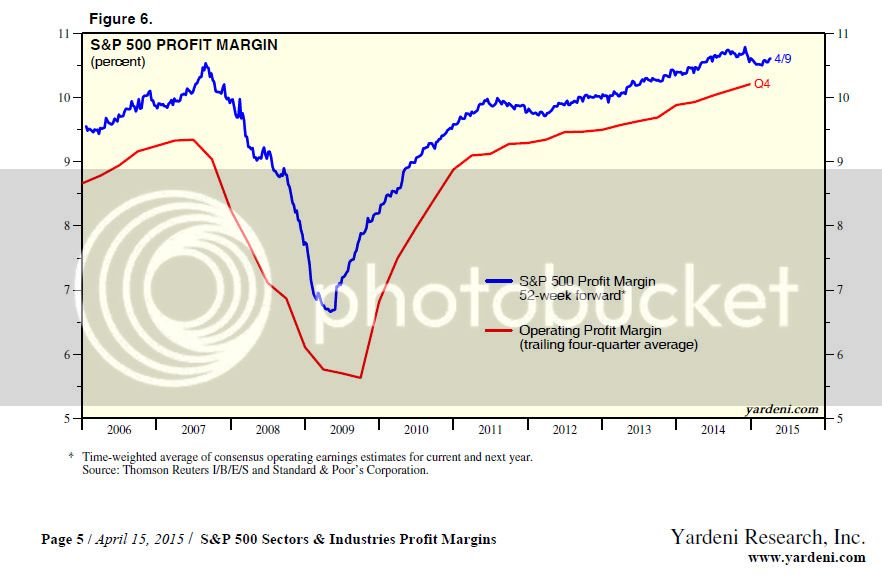

Coca-Cola Profit Margin (Quarterly): 7.08% for Dec. 31, 2014

Ford Motor Profit Margin (Quarterly): 0.14% for Dec. 31, 2014

AT&T Profit Margin (Quarterly): -11.55% for Dec. 31, 2014

Wal-Mart Stores Profit Margin (Quarterly): 3.77% for Jan. 31, 2015

Exxon Mobil Profit Margin (Quarterly): 7.64% for Dec. 31, 2014

How many of you would have justified paying for a die-cast War Machine Mk. I from IM2 instead?

Yup I did, why haven't you

I'm too busy trying to get through pages of off topic profit margin chatter.

but I don't feel good about it.

but I don't feel good about it. You and me both

I orderedbut I don't feel good about it.

I've been saying for a while I may just get Patriot as the design suits him better, wait in hope of a bulky bad-ass WM in Phase 3 or a redo of the IM2 version.I do want a WM but already have the IP. I don't want to get the same looking figure so Im just gonna wait for wm mark 3. I hope rhody survives AoU! [emoji14]ray: