Never said anything about it being state or federal law. Just said it was the law.That's a federal law, not state. I live in California and it's like the same with any state, some places charge for shipping and some don't. I don't pay sales tax and order from shops that don't charge it if I can find them. I don't pay sales tax from Timewalker Toys for instance.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

InArt Phoenix Joker 1/6

- Thread starter GaryPool

- Start date

Help Support Collector Freaks Forum:

This site may earn a commission from merchant affiliate

links, including eBay, Amazon, and others.

Chopper Face

Super Freak

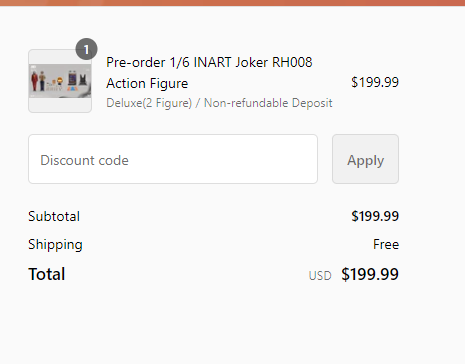

And so it begins…a €1200 figure

The double set plus dioramas costs this much so that sum is now wholly assigned to a single figure- just like with ‘the $1K Ledger Joker.’

I’m gonna see what GunDamit offer price-wise.

They won’t list this for like 10 days but might have a good deal- especially with regards to shipping, where they somehow manage to smoke all the other competition.

Luisenigma1

Super Freak

- Joined

- Aug 22, 2011

- Messages

- 7,837

- Reaction score

- 5,219

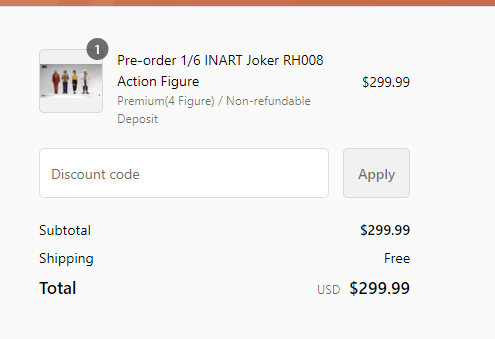

Will probably buy the deluxe and put my preorder down next week. It's going to be insane paying a NRD at $200 but thinking how It's not as bad as it would have been as Ledger Joker two pack or the "all in" pack for Batman and Bruce Wayne. Definitely going with this.

Last edited:

- Joined

- May 6, 2021

- Messages

- 24

- Reaction score

- 11

It is for the IOSS shipping to EU countrys to avoid additional taxes. So actually it is not a payment for shipping.As I said, shipping is free through them. Not sure why they were charged $5 there. Maybe it's a specific country thing? Never saw someone get charged $5 for shipping before. Their entire website is free shipping on all items, just like Kit.

Attachments

Nosferatus_lair

Nosferatu

It's $5, your insulted by $5 when your forking out $1200 or $1700 for a figure and your crying over $5!!!! Nobody making you buy it from Giantoy. Buy wherever you want. I happily buy from Giantoy and that's my choice. Ive had alot of dealings and purchases with Giantoy and their customer care and service is second to none. Absolute brilliant. I am charged $5 I'm in Ireland could be because of my country.

$14.99

DC Comics, 12-Inch Superman Action Figure, Collectible Kids Toys for Boys and Girls

Bopster USA Inc

Calm down, it was a simple misunderstanding which was cleared up. No one was crying over the amount, I’ve spent a lot in this hobby, to the point of ridicule.It's $5, your insulted by $5 when your forking out $1200 or $1700 for a figure and your crying over $5!!!! Nobody making you buy it from Giantoy. Buy wherever you want. I happily buy from Giantoy and that's my choice. Ive had alot of dealings and purchases with Hiantoy and their customer care and service is second to none. Absolute brilliant. I am charged $5 I'm in Ireland could be because of my country.

Nosferatus_lair

Nosferatu

OK, it could be because of a logistics thing to my country, I always pay $5 shipping on giantoy. And what's $5 when I'm spending $1200 really!! Also, it takes 2 weeks for figures to arrive to me from Asia. Its probably to do with extra logistics etc.Calm down, it was a simple misunderstanding which was cleared up. No one was crying over the amount, I’ve spent a lot in this hobby, to the point of ridicule.

Last edited:

- Joined

- May 27, 2017

- Messages

- 3,057

- Reaction score

- 5,740

As I said, shipping is free through them. Not sure why they were charged $5 there. Maybe it's a specific country thing? Never saw someone get charged $5 for shipping before. Their entire website is free shipping on all items, just like Kit.

Thats the tax for EU region since they announced the tax prepay system 2 years ago

Everyone shipping to EU will pay some tax otherwise the custom play with you or receiver

brownsaiyan

Just a little freaky

I also live in EU. And I'm thinking of buying it from here. However, the website is currently still blocked. I message them on FB, so now I need to wait. But I'm not 100% sure I will buy it from them though. It depends what the shipping will be. Could you maybe check for me what the Fedex shipping to Netherlands would be, for the premium one? Because Fedex is a bit more expensive. Thanks is advance!I go with Giantoy because for the simple reason thy save me hundreds of euros of import fees. With Giantoy I pay NOTHING

Now apply 25% of 1200 on top. (€300) making it €1500 for the 2 pack. That'd be my customs fees to recieve my package

Nosferatus_lair

Nosferatu

It should be $5 also. Netherlands is in the EU isn't it?I also live in EU. And I'm thinking of buying it from here. However, the website is currently still blocked. I message them on FB, so now I need to wait. But I'm not 100% sure I will buy it from them though. It depends what the shipping will be. Could you maybe check for me what the Fedex shipping to Netherlands would be, for the premium one? Because Fedex is a bit more expensive. Thanks is advance!

I want the red suit and diorama. But I can't justify another Inart deluxe + shipping. Especially when I'm only interested in half the set.

Then again I love this portrayal. I really like the film. One of the greatest theatrical experiences I ever had. And the Murray scene in particular is not only the best and most memorable scene from the film, but one of the most iconic scenes in recent cinema. So this diorama is the ideal representation for me, and I'm confident there won't be a better offering.

Damn

Then again I love this portrayal. I really like the film. One of the greatest theatrical experiences I ever had. And the Murray scene in particular is not only the best and most memorable scene from the film, but one of the most iconic scenes in recent cinema. So this diorama is the ideal representation for me, and I'm confident there won't be a better offering.

Damn

Until now I never had any bad luck with Kit or KGHobby, so far no custom fees. Fingers crossed it stays that way.I go with Giantoy because for the simple reason thy save me hundreds of euros of import fees. With Giantoy I pay NOTHING

Now apply 25% of 1200 on top. (€300) making it €1500 for the 2 pack. That'd be my customs fees to recieve my package

I am located in the EU as well.

- Joined

- May 27, 2017

- Messages

- 3,057

- Reaction score

- 5,740

I think this is the basic for Asia stores to step in EU marketUntil now I never had any bad luck with Kit or KGHobby, so far no custom fees. Fingers crossed it stays that way.

I am located in the EU as well.

its funny when people mentioned they have to pay custom/taxes ordering from onesixthkit but ending up they don't know who is onesixthkit

Sideshow was the only place I got hit with customs, back in the early days before I knew Kit and the other Asian shops. Better days now.I think this is the basic for Asia stores to step in EU market

its funny when people mentioned they have to pay custom/taxes ordering from onesixthkit but ending up they don't know who is onesixthkit

Last edited:

zexion_armando

Super Freak

- Joined

- Oct 15, 2014

- Messages

- 526

- Reaction score

- 369

At this point, I should see about selling my InArt Ledger prison figure+diorama to fund this figure so then I can sell the Arthur half later lol.

InArt should be changed to InPart since it seems people keep parting out the halves they don’t need lol

InArt should be changed to InPart since it seems people keep parting out the halves they don’t need lol

dukefett

Super Freak

I mean sure everyone is supposed to pay those taxes, but we're not talking in this forum about what sites do or don't charge sales tax for the purpose of anyone actually intending on paying it. Everyone is avoiding the sales tax if they can.Technically (and correct me if I’m wrong), the consumer is supposed to pay “use tax” on any eligible item that was not assessed CA sales tax from an out of state seller.

It should be declared with payments made when state tax returns are filed annually.

However, I’m guessing this is difficult for the state to track/audit and rarely enforced. Probably only for big ticket items like a car or boat, where the vehicle needs to be registered.

Also, I think Timewalker may collect CA sales tax on some items - for the BTTF3 Delorean, the fine print stated that it would be “drop shipped” direct from Sideshow’s distributor - as opposed to SSC shipping it to TW (Kansas) and TW re-shipping to the consumer (CA).

You mentioned:Never said anything about it being state or federal law. Just said it was the law.

"They" being California as your sentence is written. Other states having to pay sales tax was brought up by a South Dakota lawsuit of all states suing that forced every other state to do it. South Dakota sued Wayfair and now we all pay, it used to be only if they had a physical location in your state. There's a dollar value limit now, it's usually surpassed by most retailers but I guess some like Timewalker or Alter Ego don't reach that threshold to start charging for out of stae.Cali always adds taxes for any e-tailer shipping to California. They passed that law some time ago.

https://en.wikipedia.org/wiki/South_Dakota_v._Wayfair,_Inc.

brownsaiyan

Just a little freaky

Yes, it is 5. It seems they don't offer FedEx anymore to Netherlands. Strange because normally this option was always available.It should be $5 also. Netherlands is in the EU isn't it?

Nothing's free forever.

I live in California. I don't give a damn, nor do i know about, other statesI mean sure everyone is supposed to pay those taxes, but we're not talking in this forum about what sites do or don't charge sales tax for the purpose of anyone actually intending on paying it. Everyone is avoiding the sales tax if they can.

You mentioned:

"They" being California as your sentence is written. Other states having to pay sales tax was brought up by a South Dakota lawsuit of all states suing that forced every other state to do it. South Dakota sued Wayfair and now we all pay, it used to be only if they had a physical location in your state. There's a dollar value limit now, it's usually surpassed by most retailers but I guess some like Timewalker or Alter Ego don't reach that threshold to start charging for out of stae.

https://en.wikipedia.org/wiki/South_Dakota_v._Wayfair,_Inc.

Similar threads

- Replies

- 1

- Views

- 206

- Replies

- 121

- Views

- 12K

- Replies

- 687

- Views

- 54K